Tuesday, December 29, 2015

Wednesday, December 23, 2015

Monday, December 14, 2015

Flood in Florida Keys Will Affect Property Values

Key Largo, USA - High tides that are peaking has turned the streets into swamps in the Florida Keys, it also brings swarms of annoying mosquitoes and smelly stagnant water. Residents are worried that this will be an impediment to the property values in the island chain.

Key Largo is the first and northernmost of the Florida Keys and just an hour drive from South Florida's two major airports. It is famous for scuba diving, snorkeling, an underwater hotel, sport fishing, eco-tours, beaches and fishing. The floods in Key Largo started late September.

Residents expected those floods but what they didn't expect were low lying streets to be swamped with 16 inches of salt water for nearly a month. Situation did improve in November, but heavy rains this December inundated those streets again.

Resident Narelle Prew, 49 who lived for 20 years on Adams Drive said it was "like a sewer". People living in the area have already signed petitions, voiced anger at community meetings and demanded that local officials do something, whether by raising roads or improving drainage.

"We are all concerned about our property values." She estimates that her home's market value at about a million dollars.

Henry Briceno a geologist at Florida International University said that, "It is like taking a peek at the future." Scientists will not be able to determine or predict exactly how fast sea levels will increase in the years ahead as the oceans warm and glaciers melt. Southeast Florida Regional Climate Change Compact Sea Level Rise Work Group are expecting that water will go up to 10 inches above the 1992 average in the next 15 years and 26 inches by 2060. By 2060, if no action is done the sea level would wipe out 12% of property value in the Keys, a string of 1,700 small islands built on porous, prehistoric coral reefs, according to a 2011 report by Florida scientists.

Come 2100, since most of the islands are less than 6 feet or 2 meters above the current sea level, a 5 foot (1.5 meter) sea water rise in the Keys would wipe out 68% of property value in the area.

Currently, the real estate market in south Florida is flourishing and more than 50% of transactions are paid for in cash due to a surge of Chinese real estate investors.

Lynda Fernandez, senior vice president of public relations at the Miami Association of Realtors said, "Our entire market area continues to experience record level sales activity and significant price growth, consistently since 2011." Sales are up 17% in Keys, the average home sale price is $512,000, up 3% from last year.

"So far we have not been seeing buyers being concerned with sea level rise, which I'm a little surprised given all the media attention it has garnered lately," said Lisa Ferringo, president of the Marathon/Lower Keys Board of Realtors.

Experts are sounding the alarm bells that in the next 15 years those investment will be washed away. As much as $15 billion could be lost in Florida property by 2030, according to Risk Management Solutions (RMS), a leading catastrophe risk modeling company which advises insurance companies.

Source

Monday, December 7, 2015

Insurance that You Don't Need

Insurance are important for our financial health and insurance that we should have are Health insurance, auto insurance, property and casualty insurance and life insurance. Some of them are mandatory and some are not, but in most cases they are. However, there are types of insurance that are not actually needed which is listed as "junk" insurance by the nonprofit consumer watchdog group Consumer Federation of America.

Here are some types of insurance that they considered junk:

This is a new insurance product that will be on the market in January 2016. This insurance is designed to protect the down payment on your home if the real-estate market go under again.

ValueInsured, which is based in Dallas named this kind of insurance as +Plus. This is not for speculative buyers since the owner will need to live in the home and he/she cannot make a claim on the the insurance for 2 years, while it lapses after 7 years.

However, this type of insurance is for debtors who might have to move suddenly for a job, like military families, or move into marginal markets that are particularly volatile, such as Stockton, California which was hit by the worst price cut during the real estate crash with home values cut by half as a result of widespread foreclosures.

According to ValueInsured, about 8 million debtors still owe more than what their house is worth, compared with more than 15 million during the worst part of the real estate crash in 2012.

The price of this insurance is about $840 for a $20,000 down payment, and it will protect a down payment of up to $200,000 for a higher premium price. However, the policy will only activate if the market along with the value of your individual home falls 10% or more, as determined by the Federal Housing Finance Agency’s House Price Index, and then you only get back either the amount of equity you lost, or the actual down payment, up to $200,000.

Joe Melendez ValueInsured chief executive said that the aim of this product is to promote the housing market to millennials, renters and parents by attempting to ensure that their down payment is protected. This product is not for everyone. If you’re buying a home that you will live in for 30 years, don’t buy this product.

A study published by Bankrate.com says that 37% of Americans have credit card debt greater than or equal to their emergency savings, meaning a steep medical bill, a car accident or other unexpected expense could push them over a budgetary cliff. Some credit card companies are offering insurance against being unable to come up with monthly payments.

This insurance that are offered by credit card companies is designed to pay your minimum balance for a period of time if you lose your job or are incapacitated or unable to work, either in the form of Debt Cancellation Contracts (DCC) or Debt Suspension Agreements (DSA). Other instances where the credit card companies can either cancel or suspend your monthly payment include divorce, military deployment or a natural disaster. If you die, the credit card company may pay off your entire balance, with other companies offering only up to a certain balance, such as $10,000.

The credit card companies say this helps protect a consumer’s FICO score, which otherwise would drop if the cardholder can't pay their dues. While some credit card companies charged a flat fee of $19.99 a month for insurance coverage, others charged between 85 cents and $1.35 per every $100 of the outstanding balance and a national median fee of 89 cents per each $100 in the balance.

The GAO report noted that of the $2.4 billion collected in 2009, just $513 million went to consumers, while $1.3 billion went into the pocket of the credit card companies in the form of earnings once reserves of $574 million were set up.

Clearly these credit card insurances is a bad deal for consumers since if you lose your job you can apply for unemployment benefits immediately.

This insurance covers existing appliances, regardless of age, make or model that are already in the house not just those newly purchased or replaced. Some insurance companies promise total coverage of all appliances and components in the house, like air condiotner, hot water heater, or a furnace for as little as $59 a month. However, most of this plan have deductibles like many other insurance products about $75 to $125 for those offered by American Home Shield. And the repairman that will do the work will get the minimum amount of work since the insurance company wants to limit the costs. Repairman ussually accept this kind of calls when things are slow.

Insurance plan like the Gerber Grow Up Plan and the Gerber Life College Plan are purchased by parents and grandparents when the baby is born and the premiums are really low while the cash value benefits are guaranteed.

The Gerber Life College Plan (endowment insurance policy) will give the policy holder a lump-sum payment at the end of the term which is about 18 to 21 years. It can be used for college, or used to fund an adult insurance coverage plan as long as premiums are getting paid. The company said its advantage is that the life coverage can continue automatically into adulthood without fear of cancellation. However distributions from the endowment insurance policies are often taxed, unlike the distributions of a 529 college savings plan or an education savings account.

Most athletes and celebrities do this, they insured body parts, J. Lo insured her butt for $27 Million, Julia Roberts insured her smile for $30 Million, retired Pittsburgh Steelers safety Troy Polamalu insured his flowing locks for $1 million, and Holly Madison insured her breasts for $1 million.

These policies are just designed to be get attention by the celebrities’ publicists, so unless you’re a celebrity or an athlete or their agent you can safely pass on this one.

Here are some types of insurance that they considered junk:

Down payment insurance

This is a new insurance product that will be on the market in January 2016. This insurance is designed to protect the down payment on your home if the real-estate market go under again.

ValueInsured, which is based in Dallas named this kind of insurance as +Plus. This is not for speculative buyers since the owner will need to live in the home and he/she cannot make a claim on the the insurance for 2 years, while it lapses after 7 years.

However, this type of insurance is for debtors who might have to move suddenly for a job, like military families, or move into marginal markets that are particularly volatile, such as Stockton, California which was hit by the worst price cut during the real estate crash with home values cut by half as a result of widespread foreclosures.

According to ValueInsured, about 8 million debtors still owe more than what their house is worth, compared with more than 15 million during the worst part of the real estate crash in 2012.

The price of this insurance is about $840 for a $20,000 down payment, and it will protect a down payment of up to $200,000 for a higher premium price. However, the policy will only activate if the market along with the value of your individual home falls 10% or more, as determined by the Federal Housing Finance Agency’s House Price Index, and then you only get back either the amount of equity you lost, or the actual down payment, up to $200,000.

Joe Melendez ValueInsured chief executive said that the aim of this product is to promote the housing market to millennials, renters and parents by attempting to ensure that their down payment is protected. This product is not for everyone. If you’re buying a home that you will live in for 30 years, don’t buy this product.

Debt cancellation or debt suspension agreements

A study published by Bankrate.com says that 37% of Americans have credit card debt greater than or equal to their emergency savings, meaning a steep medical bill, a car accident or other unexpected expense could push them over a budgetary cliff. Some credit card companies are offering insurance against being unable to come up with monthly payments.

This insurance that are offered by credit card companies is designed to pay your minimum balance for a period of time if you lose your job or are incapacitated or unable to work, either in the form of Debt Cancellation Contracts (DCC) or Debt Suspension Agreements (DSA). Other instances where the credit card companies can either cancel or suspend your monthly payment include divorce, military deployment or a natural disaster. If you die, the credit card company may pay off your entire balance, with other companies offering only up to a certain balance, such as $10,000.

The credit card companies say this helps protect a consumer’s FICO score, which otherwise would drop if the cardholder can't pay their dues. While some credit card companies charged a flat fee of $19.99 a month for insurance coverage, others charged between 85 cents and $1.35 per every $100 of the outstanding balance and a national median fee of 89 cents per each $100 in the balance.

The GAO report noted that of the $2.4 billion collected in 2009, just $513 million went to consumers, while $1.3 billion went into the pocket of the credit card companies in the form of earnings once reserves of $574 million were set up.

Clearly these credit card insurances is a bad deal for consumers since if you lose your job you can apply for unemployment benefits immediately.

Home warranty insurance

This insurance covers existing appliances, regardless of age, make or model that are already in the house not just those newly purchased or replaced. Some insurance companies promise total coverage of all appliances and components in the house, like air condiotner, hot water heater, or a furnace for as little as $59 a month. However, most of this plan have deductibles like many other insurance products about $75 to $125 for those offered by American Home Shield. And the repairman that will do the work will get the minimum amount of work since the insurance company wants to limit the costs. Repairman ussually accept this kind of calls when things are slow.

Child insurance

Insurance plan like the Gerber Grow Up Plan and the Gerber Life College Plan are purchased by parents and grandparents when the baby is born and the premiums are really low while the cash value benefits are guaranteed.

The Gerber Life College Plan (endowment insurance policy) will give the policy holder a lump-sum payment at the end of the term which is about 18 to 21 years. It can be used for college, or used to fund an adult insurance coverage plan as long as premiums are getting paid. The company said its advantage is that the life coverage can continue automatically into adulthood without fear of cancellation. However distributions from the endowment insurance policies are often taxed, unlike the distributions of a 529 college savings plan or an education savings account.

Body parts

Most athletes and celebrities do this, they insured body parts, J. Lo insured her butt for $27 Million, Julia Roberts insured her smile for $30 Million, retired Pittsburgh Steelers safety Troy Polamalu insured his flowing locks for $1 million, and Holly Madison insured her breasts for $1 million.

These policies are just designed to be get attention by the celebrities’ publicists, so unless you’re a celebrity or an athlete or their agent you can safely pass on this one.

Thursday, November 26, 2015

CDC has Warn the Public About the Deadly "Kissing Bug?" (Triatomine Bugs)

The Centers for Disease Control and Prevention CDC has warn

the public about the spread Kissing Bug throughout the United States. Kissing

Bug are Triatomine Bugs, they are blood-sucking bugs that usually bites the

face of their victims. These bugs carries a possibly fatal disease called

Chagas.

The kissing bug recently made its way to Georgia, Alabama

and California, although health officials said the insect has been around the

U.S. since the 1850s.

The bug looks like a cockroach and it earned the name kissing

bug since it feeds on the blood of mammals, usually by biting them on or around

the lip. Chagas disease, which can be

fatal if left untreated, according to the CDC. There are currently about

300,000 cases of Chagas in the U.S.

The bugs are typically found outdoors but they can tend to

hide under beds and mattresses.

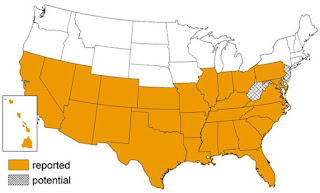

The CDC provided a map of states that have reported of the

bug:

Source: The Centers for Disease Control and Prevention

How to avoid them: The CDC recommends synthetic pyrethroid

sprays, this have been proven effective against the bug in Latin America. You

can also seal all your windows, roofs and doors. It is also great to have

screens over windows and doors, minimize yard lights as the bugs are attracted

to light, seal all holes and cracks throughout the house, having pets sleep

inside and regularly checking for the bugs is extremely helpful.

Monday, November 16, 2015

Obamacare: High Deductibles and Higher Premiums

Bad news for Obamacare enrollees, reports said that there will be an increase in the out-of-pocket costs for deductibles next year 2016 that will significantly diminish the benefits of consumers health care plans and this will further discourage some from purchasing coverage.

Robert Laszewski, president of Health Policy & Strategy Associates, said “That these deductibles are so high is clearly one of the reasons people aren’t buying a plan—they simply don’t see themselves getting anything for the money.”

People have until the end of the year to enroll themselves for the 3rd season of Obamacare. The government said that there are a lot of plans available with low premiums however, most of those plans requires you to pay huge out of pocket costs before they Obamacare coverage actually kicks in.

The average annual out-of-pocket costs per worker increased nearly 230 percent between 2006 and 2015, according to an annual survey of employer health benefits coverage by the Kaiser Family Foundation.

The New York Times report said that majority of the states and more than half the plans being sold on Obamacare insurance exchanges have a deductible of $3,000 or more.

Median deductible in Miami is $5,000. In Jackson, Miss the median deductible is $5,500. Chicago is $3,400. Phoenix $4,000. While in Des Moines, Iowa, it is $3,000.

It is also revealed by the government that Obamacare will not hit their 10 million target by next year. Also another problem hounding the Obamacare is the rising premiums for policies the median rate increase for the lowest priced, most popular “Silver” plan will rise by 11% compared to just a 7% increase in 2015.

Monday, November 9, 2015

Anbang Insurance Group of to acquire Fidelity & Guaranty Life US

Anbang Insurance Group Co., Ltd., a leading global comprehensive insurance group based in Beijing, China, will buy the Fidelity & Guaranty Life FGL, -1.64% ("FGL"), a leading provider of annuities and life insurance in the U.S. for about $1.57 billion as Chinese insurers seek to expand into the United States.

According to Anbang, they will pay $26.80 per share, a premium of 3% to the stock's Friday close.

Fidelity & Guaranty's stock was down 1% at $25.98 in early trading.

The purchase will turn Anbang as one of the largest insurers by market share in fixed indexed annuity products in the United States. It is expected that FGL's solid life and fixed indexed annuity platforms will enhance the growth of Anbang's business while accelerating FGL's ability to further extend its policyholder base.

Financial holding company HRG Group Inc, Fidelity & Guaranty Life's majority stockholder, has approved the deal. The deal is expected to close in the second quarter of 2016.

Affordable Care Act: 500,000 plus sign up for Insurance

More than 500,000 has already submitted their application to purchase insurance under the Affordable Care Act on healthcare.gov according to U.S. Department of Health and Human Services.

Department spokesman Benjamin Wakana said that 250,000 applications were sent in the first 48 hours.

Enrollment for 2016 opened on November 1, 2015 throughout the country. They want to see if the number of uninsured people will drop. 28.5 million people in the US are still uninsured according to the U.S. Centers for Disease Control's National Center for Health Statistics.

Texas topped the states with the most number of uninsured (20% or about 5 million people), followed by Alaska (17.2%), Florida (16.6%), Georgia (15.8%) and Oklahoma (15.4%).

Enrollment will continue up to January 31, 2015. Federal officials urge people to consider enrolling early or by mid-December to ensure uninterrupted coverage.

Saturday, October 31, 2015

Happy Halloween

Happy Halloween! I hope you enjoy all the fun festivities and have a super scary costume ready.

Save some candy for us!

Have a “spook”tacular Halloween!

Friday, October 23, 2015

Obamacare: Open enrollment Nov 1 to Jan 31

The open enrollment for health coverage under the Affordable Care Act (Obamacare) will start on November 1 to January 31, 2015. This will be the 3rd year of health care sign-ups. Covered California officials said that there are still 2 million residents who are uninsured, primarily Latinos and African Americans and 36% of them don't know that they may be entitled to premium subsidies available under the Affordable Care Act. In contrast, only 16% didn't know about the tax penalty for lacking health coverage.

Covered California exchange have 500 storefront locations, they employ thousands of enrollment counselors, and have launched a $29 million advertising campaign and a statewide bus tour, to encourage more Californians to come under the health care umbrella.

They said that about 90% of the 1.3 million Covered California enrollees receive subsidies, and more than 200,000 people pay less than $50 a month thanks to that financial assistance.

For those who are uninsured tax penalties for not having health care coverage will increase again in 2016. Under the federal health care law, those without health insurance in 2016 may be subject to a federal tax penalty, which starts at $695 per person in a household or 2.5 percent of income, whichever is greater. For a family of four earning $70,000 a year that chooses not to purchase health care coverage for 2016, the tax penalty could be $2,085, according to Covered California.

For a family of three with an annual income of $61,021 living in Los Angeles I got these premium rates: Molina bronze $332, $0 monthly premium assistance, Oscar Bronze $396, Anthem Bronze $398 and Kaiser Permanente $403. Well, if you ask me those rate are expensive no wonder they are not signing up. If they just used the $29 million they pay for advertising in improving the discount then it would have been great.

Covered California exchange have 500 storefront locations, they employ thousands of enrollment counselors, and have launched a $29 million advertising campaign and a statewide bus tour, to encourage more Californians to come under the health care umbrella.

They said that about 90% of the 1.3 million Covered California enrollees receive subsidies, and more than 200,000 people pay less than $50 a month thanks to that financial assistance.

For those who are uninsured tax penalties for not having health care coverage will increase again in 2016. Under the federal health care law, those without health insurance in 2016 may be subject to a federal tax penalty, which starts at $695 per person in a household or 2.5 percent of income, whichever is greater. For a family of four earning $70,000 a year that chooses not to purchase health care coverage for 2016, the tax penalty could be $2,085, according to Covered California.

For a family of three with an annual income of $61,021 living in Los Angeles I got these premium rates: Molina bronze $332, $0 monthly premium assistance, Oscar Bronze $396, Anthem Bronze $398 and Kaiser Permanente $403. Well, if you ask me those rate are expensive no wonder they are not signing up. If they just used the $29 million they pay for advertising in improving the discount then it would have been great.

Sunday, October 18, 2015

Life Insurance Coverage 101

Know the basics on your life insurance coverage, since it is a long term investment that will protect your love once. Life insurance should be designed to fit your situation so it is not an "one size fits all." Most people, get the most coverage for the lowest cost as possible that they can afford.

Whole-life or permanent life insurance - this policy combines death benefit for love ones with a cash value that you can access while you are still alive.

Term insurance is a wise choice for younger and healthy people who are just starting out with life insurance since it is less costly. In term insurance you can keep your premiums as low as possible.

Married couple usually purchase this kind of life insurance to keep them secured financially in an event one dies. Most companies also offers this kind of insurance policy as added employee benefits. However, if you leave your company the policy will end.

Term insurance expires after a stated period of time or once you reach a specific age, so your love once is only secured during the stated term. This kind of life insurance is feasible only when you are young because they get much more expensive as you age.

Permanent life insurance has a number of kinds, that include traditional whole life, variable life, universal life or variable universal life. Just like the term insurance policy your beneficiaries will get paid when you die, the difference is that it doesn't have a stated termination date. If you have paid the adequate amount of premiums and the policy is in force, your love ones will receive the death benefit.

Premiums are higher and there are often have additional costs for permanent life insurance compared to term insurance policies. This type of life insurance also has cash value that accumulates as you pay premiums. Premium payments must be sufficient to avoid a policy lapse, but a portion of those payments accrue within the policy and can grow on a tax-free basis.

Before purchasing life insurance coverage make sure that you have assess every option there is and make sure that you have discuss your choices with a financial adviser.

There are two types of life insurance policies:

Term life insurance - this is basically a policy that gives death benefit for love once after you die. There are no other features.Whole-life or permanent life insurance - this policy combines death benefit for love ones with a cash value that you can access while you are still alive.

Term insurance is a wise choice for younger and healthy people who are just starting out with life insurance since it is less costly. In term insurance you can keep your premiums as low as possible.

Married couple usually purchase this kind of life insurance to keep them secured financially in an event one dies. Most companies also offers this kind of insurance policy as added employee benefits. However, if you leave your company the policy will end.

Term insurance expires after a stated period of time or once you reach a specific age, so your love once is only secured during the stated term. This kind of life insurance is feasible only when you are young because they get much more expensive as you age.

Permanent life insurance has a number of kinds, that include traditional whole life, variable life, universal life or variable universal life. Just like the term insurance policy your beneficiaries will get paid when you die, the difference is that it doesn't have a stated termination date. If you have paid the adequate amount of premiums and the policy is in force, your love ones will receive the death benefit.

Premiums are higher and there are often have additional costs for permanent life insurance compared to term insurance policies. This type of life insurance also has cash value that accumulates as you pay premiums. Premium payments must be sufficient to avoid a policy lapse, but a portion of those payments accrue within the policy and can grow on a tax-free basis.

Before purchasing life insurance coverage make sure that you have assess every option there is and make sure that you have discuss your choices with a financial adviser.

Thursday, September 24, 2015

AIG's Couture Insurance For Shoes and Designer Wardrobe Collections

You can now insure your expensive Louis Vuitton, Hermes, or Christian Louboutin thanks to AIG Private Client Group (a division of American International Group Inc. NYSE: AIG). The insurance company has introduced a more specialized insurance that is specifically designed for couture and designer wearable collections for its high net worth policyholders.

The new couture insurance product will give coverage not typically found in a homeowners policy and recognizes the high value placed on the fine craftsmanship of high-end designer fashions and wardrobe accessories.

It covers couture and ready-to-wear garments, shoes, handbags, and vintage and historic clothing. They will be individually itemized in the policy with the option to use blanket coverage for less expensive items. The insurance will cover damage caused by flood, mold, and moths, risks often excluded from a homeowners policy. Additionally, it covers custom, work-in-progress couture and shoes, as is reimbursement of expenses for clients who protect their couture by removing it from the home in advance of an impending threat.

Also, the insurance covers dry cleaning and wardrobe preparation expenses by a high-end garment care specialist following a covered loss. This is a common prerequisite for acceptance into a secure garment storage facility.

In developing this coverage, AIG worked with Garde Robe Online, LLC, a wardrobe storage and preservation service, to identify coverage features that would address real concerns for collectors.

New home sales In the US is Up by 5.7% in August 7-year high

Newly built homes being sold has posted the highest level since early 2008 in August, that's more than 7 years. This shows that the demand in housing is strengthening. New single-family homes sales were up by 5.7% to a seasonally adjusted annual rate of 552,000 according to the Commerce Department. The increase in sales is a result of steady job gains and low mortgage rates. The real estate market hast been really hit hard by the Great Recession and recovered slowly even after the downturn ended in 2009. New-home sales have soared nearly 22% in the past year.

Strong sales in newly built home and construction could help the economy by generating construction jobs, demand for more building materials and more spending on landscaping and other services.

Home builders raised new-home prices aggressively last year, likely weighing on sales, which totaled just 414,000 in 2014. That was little changed from sales in 2013. But builders have reined in price increases this year, fueling more buyer traffic and purchases.

Federal Reserve Chair Janet Yellen said last week that she expects the housing market to keep improving as more people find jobs and younger Americans increasingly move out on their own.

Tuesday, August 18, 2015

Amazon Criticized for Toxic Working Environment, Amazon founder respond

Last Saturday an article on the New York Times blasts Amazon because of its working conditions in the company. Entitled "Inside Amazon: Wrestling Big Ideas in a Bruising Workplace" it exposed how the company pressured their employees with their “unreasonably high” standards. The report detailed the company's lack of empathy for employees' health-related issues. There were instances when employees that suffered from cancer, miscarriages and other personal crises said they had been evaluated unfairly or edged out rather than given time to recover. A woman employee who suffers with breast cancer was placed on "performance improvement plan" because personal issues were affecting her work.

And because of the backbreaking work and Amazon's penchant of extracting unreasonable work from their employees Amazon has expanded tremendously their campus is now a 10-million-square-foot with thousands of new workers. Amazon has also eclipsed Walmart as the most valuable retailer in the US at $250 billion and their CEO Jeff Bezos is the 5th wealthiest person in the world.

Bezos responded with a memo to Amazon employees defending the culture at the company and encouraging employees who heard of similar stories to contact him as well as human resources.

He said, "Even if it's rare or isolated, our tolerance for any such lack of empathy needs to be zero," "The people we hire here are the best of the best. You are recruited every day by other world-class companies, and you can work anywhere you want."

Sucharita Mulpuru-Kodali, an Amazon analyst with Forrester Research said that "most of the allegations sound consistent with things that former employees have told me about the company."

- Work work work work, corporations greedy goal to accumulate more money and wealth are turning people into stupid zombies with no life. We are not robots mr CEO.

Wednesday, August 5, 2015

Pew poll: Japanese Thinks Americans are Lazy and Intolerant

According to a poll about U.S.-Japan relations conducted by Pew Research Center, Americans have a positive views of Japanese while the Japanese generally have negative views of Americans.

In the survey, people were asked five traits hardworking, inventive, honesty, intolerant, aggressive, and selfish. The results shows that Japanese people don't like Americans that well, while Americans do like Japanese.

What Americans think about Japanese people: hardworking 94%, inventive 75%, honest 71%, intolerant 36%, aggressive 31%, and selfish 19%.

How Japanese view the Americans: hardworking 25%, inventive 67%, honest 37%, intolerant 29%, aggressive 50%, and selfish 47%.

Sunday, July 19, 2015

How to Claim Social Security Disability Insurance

Social Security Disability Insurance (SSDI) serves as a lifeline for about a million of workers and their families in the country. It gives insurance protection to workers and their families when they retire or in case of a serious, long-term disability.

The benefits of Social Security Disability Insurance is modest. Beneficiaries of it get about $42,000 on average, based in 2014 wage levels.

Qualification for Online Application for disability benefits:

- 18 years old or above

- You are not currently receiving benefits on your own Social Security record

- You are unable to work because of a medical condition that is expected to last at least 12 months or result in death: and

- You have not been denied disability benefits in the last 60 days. If your application was recently denied for medical reasons, the Internet Appeal is a starting point to request a review of the medical determination we made.

Here's How To Apply Online For Disability Benefits:

1. Print, review and gather the information needed in the Adult Disability Checklist.

2. Complete the Disability Benefit Application Online here.

Documents needed:

- The date of your injury or illness;

- The amount and effective date of your current payment and all increases or decreases within the last 17 months or, if later, since payments began;

- if receiving workers' compensation, the type of payment (i.e., temporary partial, temporary total, permanent partial, permanent total, a lump sum or an annuity;

- The frequency of your payments (e.g. weekly, bi-weekly, monthly, bi-monthly, etc.) or the period covered by a lump sum;

- If benefits have already ended, the last day you were entitled to a payment and your last payment amount (if different than your regular payment amount);

- Your employer's name and address; and

- If other than your employer, the name and address of the insurance carrier making the payments.

Information needed:

Information About You

- Your date and place of birth and Social Security number

- The name, Social Security number and date of birth or age of your current spouse and any former spouse. You should also know the dates and places of marriage and dates of divorce or death (if appropriate)

- Names and dates of birth of your minor children

- Your bank or other financial institution's Routing Transit Number [more info] and the account number, if you want the benefits electronically deposited

- Name, address and phone number of someone we can contact who knows about your medical conditions and can help with your application

- Detailed information about your medical illnesses, injuries or conditions: Names, addresses, phone numbers, patient ID numbers and dates of treatment for all doctors, hospitals and clinics;

- Names of medicines you are taking and who prescribed them; and

- Names and dates of medical tests you have had and who sent you for them.

- The amount of money earned last year and this year

- The name and address of your employer(s) for this year and last year

- A copy of your Social Security Statement

- The beginning and ending dates of any active U.S. military service you had before 1968

- A list of the jobs (up to 5) that you had in the 15 years before you became unable to work and the dates you worked at those jobs

- Information about any workers' compensation, black lung, and/or similar benefits you filed, or intend to file for. These benefits can:

- Include annuities and lump sum payments that you received in the past;

- Be paid by your employer or your employer's insurance carrier, private agencies, or Federal, State or other government or public agencies; and

Be referred to as:

- Workers' Compensation;

- Black Lung Benefits;

- Longshore and Harbor Workers' Compensation;

- Civil Service (Disability) Retirement;

- Federal Employees' Retirement;

- Federal Employees' Compensation;

- State or local government disability insurance benefits; or

- Disability benefits from the military (This includes military retirement pensions based on disability but not Veterans' Administration (VA) benefits.)

Once they receive your online application, they will:

- Provide confirmation of your application- either electronically or by mail.

- Review the application.

- Contact you if we need more information or documentation.

- Inform you if other family members may be able to receive benefits on your record, or if you may be able to receive benefits on another person’s record, such as your spouse or your parent.

- Process your application.

- Mail their decision to you.

Friday, July 3, 2015

Aetna will buyout rival health insurer Humana for $37 billion

Health insurance company Aetna Inc is said to have struck a deal to purchase Humana Inc for about $37 billion, or roughly $230 per Humana share, in a cash-and-stock deal.

Humana shareholders will get $125 in cash and 0.8375 Aetna shares for each share held, an about 23% premium to the stock's closing price on Thursday. Following the deal, Aetna's shareholders would own about 74% of the combined company.

Once done the new company will boast more than 33 million members, and bring in estimated revenue of about $115 billion per year. 56% of the revenue will be from government-sponsored programs like Medicare.

Tuesday, June 30, 2015

Worst companies for Employees

24/7 Wall St. has listed the worst companies to work for. 24/7 Wall St. based their list from data on jobs and career website Glassdoor. They have compiled and analyzed data on more than 400,000 companies worldwide.

The average company rating on Glassdoor is 3.2 out of 5.

Here are the 12 U.S. companies that are worst for employees:

12. CVS Health (CVS) - Rating: 2.7

11. Computer Sciences Corporation (CSC) - Rating: 2.7

10. Dollar General (DG) - Rating: 2.7

9. Ross Stores (ROST) - Rating: 2.7

8. DISH Network (DISH) - Rating: 2.6

7. AECOM (NYSE:AECOM) - Rating: 2.6

6. Sears (SHLD) - Rating: 2.5

5. Xerox (XRX) - Rating: 2.5

4. Forever 21 - Rating: 2.5

3. Kmart (SHLD) - Rating: 2.5

2. Dillard’s (DDS) - Rating: 2.4

1. Express Scripts (ESRX) - Rating: 2.3

Thursday, June 25, 2015

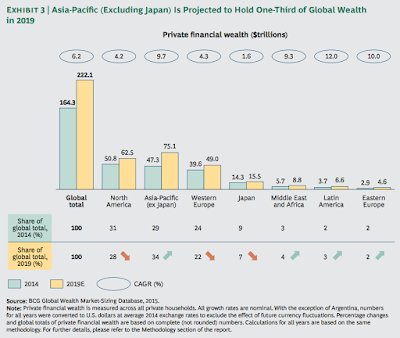

Asia Pacific Overtake Europe in Wealth and is Expected to Hold 1/3 of Global Wealth in 2019

The Asia-Pacific region has overtaken Europe in the area of private financial wealth in 2014. The Boston Consulting Group estimated that East and West Europe holds a private wealth of $42.5 trillion, while the Asia-Pacific (Japan not included) is growing at a fast pace and now holds $47.3 trillion. They are also expected to ave more than one-third of the $222 trillion global total by 2019.

Asia-Pacific (Japan not included) will surpass the North America's private financial wealth by 2016.

BCG's estimate of total financial wealth:

- North America: $50.8 trillion (+5.6%)

- Asian-Pacific (Japan not included): $47.3 trillion (+29%)

- Western Europe: $39.6 trillion (+6.6%)

- Japan: $14.3 trillion (+2%)

- Middle East and Africa: $5.7 trillion (+9.4%)

- Latin America: $3.7 trillion (+10.5%)

- Eastern Europe: $2.9 trillion (+18.8%)

Saturday, June 13, 2015

Los Angeles increase minimum wage to $15 per hour

Los Angeles Mayor Eric Garcetti, with members of the City Council and community leaders in attendance, signed into law an ordinance that will slowly increase the minimum wage to $15 an hour by 2020 at Martin Luther King Jr. Park in Los Angeles, on Saturday, June 13, 2015. It makes the Los Angeles the largest city in the U.S. to gradually raise the minimum wage to $15 per hour.

With the law, Los Angeles minimum wage will increase gradually:

July 2016 - from $9 to $10.50

Then yearly increase of $12 (2017), $13.25 (2018), $14.25 (2019)and $15 (2020).

Small businesses and nonprofits organization will have an extra year to phase in the increases.

Saturday, June 6, 2015

Brace Yourself Health Insurance Companies are Seeking Rate Increases up to 27%

For Arizona residents who purchase their own health insurance maybe in for a big surprise next year they are faced up to 27% rate increase. Health Insurance companies said that the increase reflect the higher medical expenses of their customers. They have filed the necessary paperwork with the state and federal regulators to increase the premiums by 11 to 27% for 15 individual plans sold on and off the Affordable Care Act marketplace.

The proposed rate hikes will not affect most Arizonans who get health insurance through an employer or a government-sponsored health plan such as Medicare, Medicaid or Veterans Affairs.

Full story here

Saturday, May 30, 2015

Health Insurer Humana Thinking of Selling

Health Insurance company Humana Inc is thinking of selling the company after it received multiple expressions of takeover interest, this could set off a round of mergers in the health care industry as it grapples with the hurdles and opportunities caused by the federal health-care overhaul.

Companies are pressured to cut costs and look for other ways to gain profit from the potential new customers because of the Affordable Care Act. Experts expected that big health insurance companies will merge to give them more opportunities to compete.

Humana is headquartered in Louisville, Kentucky. Majority of its income is from its business administering the private version of the federal Medicare program. The company prized because of its powerful Medicare franchise, which is on the uptrend as baby boomers age into eligibility and opt for these plans, known as Medicare Advantage.

Wednesday, May 20, 2015

Los Angeles Votes 14-1 for $15 minimum wage

The Los Angeles City Council voted last Tuesday 14-1 in favor of the $15 minimum wage increase, after they hear the statements of residents for and against the plan. There are about 700,000 people earning minimum wage in Los Angeles, the city also has the highest housing costs in the country. Los Angeles will be the 2nd largest city to increase the minimum wage to $15 from $9.

The measure will be sent to the city attorney to prepare a wage ordinance. That ordinance will then go to a council committee and if it get pass it will go to the full council for a final vote and then to Mayor Eric Garcetti.

This will require businesses with more than 25 employees to meet the $15 pay level by 2020, while smaller businesses would have an extra year to comply.

Wednesday, May 6, 2015

Now you can Track Your Pizza Using Pizza Hut app

Can't wait for your Pizza deliver? You can now track it real time using the new Pizza Hut app, you no longer have to ask "Where's my pizza?" They are calling it "Pizza Navigation System" and it runs like Uber's tracking app. The customer will have the ability to track the location of the delivery guy's vehicle on a map on the way to the customer's location.

Pizza Hut said that the service will "allow customers to plan for meal time while Pizza Hut simultaneously manages its fleet of drivers to ensure an efficient ordering process."

The picture of the delivery guy will also be shown on the app so that the customer will know who to expect at their door. The service was first rolled out in Russia and Israel in 2014. It will debut in the Dallas area soon, and be expanded through out the country later this year.

Thursday, April 16, 2015

Job Search Website Listed 10 worst and best jobs of 2015

Careercast, a job search website listed the 10 worst and best jobs for the year 2015 and too bad for the newspaper reporters they top the list of worst job in the U.S. Another 2 media professions are in the list of the worst Broadcaster in number 5, while Photojournalist is in number 6.

Now you can't blame former Houston Chronicle newspaper reporter Sarah Tressler for having a second job as a stripper

The ranked is based on income, stress, outlook and environmental factors, they collected the data from the Bureau of Labor Statistics.

The best job in 2015 is Actuary, a profession which calculate financial risk.

The worst of 2015

1. Newspaper reporter

2. Lumberjack

3. Enlisted military personnel

4. Cook

5. Broadcaster

6. Photojournalist

7. Corrections officer

8. Taxi driver

9. Firefighter

10. Mail carrier

The best of 2015

1. Actuary

2. Audiologist

3. Mathematician

4. Statistician

5. Biomedical engineer

6. Data scientist

7. Dental hygienist

8. Software engineer

9. Occupational therapist

10. Computer systems analyst

Saturday, April 4, 2015

Supporters of Memories Pizza raise $842,387 after backlash over Standing Ground with their Beliefs in regards to Gay Marriage

Supporters of Memories Pizza raise $842,387 after backlash over when the owners stand their ground on their Beliefs in regards to Gay Marriage.

A local Indiana pizza shop "Memories Pizza" has closed down after coming under fire from Liberals and LGBT communities after an interview Co-owner Crystal O'Connor which she said that she would refuse to cater a gay wedding. The supporters of the local Pizzeria has now raised $842,387 online in just 4 days.

"Donations are now closed. Grand total of $842,387 raised for #MemoriesPizza. You stood in the gap with them. Thank you!"

http://www.gofundme.com/MemoriesPizza

Lawrence Jones created the fund-raiser, he is a regular contributor for conservative radio program, "The Diana Show," which is publicly backing O'Connor's family.

"All money, save whatever percentage GoFundMe takes, will be transferred directly to whichever bank account the O'Connors wish to use," according to Lawrence.

In a related news, A bitter CBS Affiliate Employee is now being investigated for a bogus fraud report against ‘Memories Pizza’ GoFundMe and she even had the gall to brag about it on Social Media.

Alix Bryan works as a social media person for WTVR-TV (CBS affiliate in Richmond, Virginia), she filed a fraud report to GoFundMe against Memories Pizza and brag about it on Twitter:

Then when someone confronted her asking why she filed a fraud complaint without basis, she replied with a lie “Also, that is totally acceptable to do. I also did research afterward and contacted person who started fund. @LilacSundayBlog @CBS6”, Lawrence Jones (the guy who started the fund) Tweet back and accused her of lying.

So, is this what she do in WTVR make up fake news report?

#firealixbryan

A local Indiana pizza shop "Memories Pizza" has closed down after coming under fire from Liberals and LGBT communities after an interview Co-owner Crystal O'Connor which she said that she would refuse to cater a gay wedding. The supporters of the local Pizzeria has now raised $842,387 online in just 4 days.

"Donations are now closed. Grand total of $842,387 raised for #MemoriesPizza. You stood in the gap with them. Thank you!"

http://www.gofundme.com/MemoriesPizza

Lawrence Jones created the fund-raiser, he is a regular contributor for conservative radio program, "The Diana Show," which is publicly backing O'Connor's family.

"All money, save whatever percentage GoFundMe takes, will be transferred directly to whichever bank account the O'Connors wish to use," according to Lawrence.

In a related news, A bitter CBS Affiliate Employee is now being investigated for a bogus fraud report against ‘Memories Pizza’ GoFundMe and she even had the gall to brag about it on Social Media.

Alix Bryan works as a social media person for WTVR-TV (CBS affiliate in Richmond, Virginia), she filed a fraud report to GoFundMe against Memories Pizza and brag about it on Twitter:

I have reported the GoFundMe for Memories Pizza for fraud. Just in case. http://t.co/ET0kGL0OWL

— Alix Bryan (@alixbryan) April 1, 2015

Then when someone confronted her asking why she filed a fraud complaint without basis, she replied with a lie “Also, that is totally acceptable to do. I also did research afterward and contacted person who started fund. @LilacSundayBlog @CBS6”, Lawrence Jones (the guy who started the fund) Tweet back and accused her of lying.

So, is this what she do in WTVR make up fake news report?

#firealixbryan

Wednesday, March 25, 2015

Southport Lane Management Insurance Empire Collapse

Southport Lane Management boast 2 insurance carriers, 2 offshore reinsurers, some buildings and other insurers’ investments however this empire was built on questionable assets and is now being dismantled. This event has raised some questions about state regulators which failed to detect potential problems of the company and the flow of new money into the insurance business.

Alexander Chatfield is a young private-equity investor in his mid-20s, state regulators approved his request to purchase two insurance companies in 2013 even though he had limited industry experience. Then after a few months regulators seized both companies because of concerns about the companies finances, exposing the flaws in how states screen prospective buyers.

Chatfield, 28 founded the private equity firm Southport Lane Management LLC in 2010, and he bought insurance carriers including workers’ compensation writer Dallas National in Texas and personal lines writer Imperial Fire & Casualty in Louisiana. Southport transferred Dallas National to Delaware and renamed Freestone, it is currently in the process of liquidation in Delaware while Imperial was seized and sold by Louisiana regulators.

His company also bought Redwood Reinsurance which is based in Cayman Islands reinsurer. Last April it reported it was selling its reinsurance business, Southport Re, to Lennox Investments.

It is alleged that Burns switched millions in stocks and bonds from the companies into a personal account and replaced those investments with non-publicly traded or valueless assets, worthless, and in some cases non-existent which include a Caravaggio painting of uncertain authenticity.

It was reported that Mr. Burns checked into a mental-health ward at New York’s Bellevue Hospital a year ago he also resigned from Southport Lane.

Saturday, March 14, 2015

Uninsured Citizens Can Still Avoid being Penalized by Obamacare

Citizens who have not yet purchased a health insurance plan can still avoid federal fines, since Washington has offered a second chance. The enrollment period will give a million people who have not yet signed up for Obamacare a one-time chance to enroll.

Most people has negative feedback with President Obama’s healthcare law it has been criticized by a lot of people. The average federal fine is at $170 which will be deducted from tax refund. 2015 will be the first year in which fines are being collected from uninsured people who are able to afford insurance.

The low and middle income individuals and self employed businessmen are among the people fined for not opting for affordable coverage. The government said that about 4 million people will have to pay fines this year if they don't sign up for the coverage during the limited-time window.

The limited time window to enroll for healthcare coverage will be open up to April 30. The penalties for this year will be higher, at $325 for 12 months.

Sunday, March 1, 2015

House Sales in the US Down by 4.9% in January

House Sales in the U.S. significantly slowed down in January, according to The National Association of Realtors in a statement. The sales of homes that are already existing was down 4.9% in January to a seasonally adjusted yearly rate of 4.82 million.

The steady employment growth and low mortgage rate have not yet encourage buyers. Poor sales last year had set up expectations of a strong rebound in 2015, but there are no signs of that happening yet. The government reported an additional 1 million new jobs over the past three months that would have spurred home-buying but it didn't, unless somebody is lying (The Big Lie: 5.6% Unemployment).

Friday, February 20, 2015

Travel Insurance is a Necessity

The primary reason for getting a travel health insurance is to have a peace of mind that your medical expenses are covered in an event of an injury or unexpected sickness during your vacation in another country. when you go abroad, you will face uncertainty and your current insurances generally will not cover the risks associated with traveling overseas.

Travel Insurance is a necessity for elderly people, those who have medical conditions, or even healthy people that will be traveling to an underdeveloped region. If you are going to an underdeveloped region there are the risk of diseases, changes in the climate, the natural habitat, or unfamiliar microbe. Even in developed countries you can be exposed to outbreaks like what happened to California Disneyland which suffered a measles outbreak.

However, most travel insurance policies do not cover pandemics (flu outbreaks) but other providers do cover them so it is wise to check if they cover it before you purchase the policy.

If you have allergies or other preexisting conditions it is really important to bring with you your medical file from your personal doctor that describe the condition and the drugs you need. If you have a chronic disease, you will need to bring your prescribed drugs in the amount needed for the days spent in the other country.

Additional benefits of having a travel insurance besides for medical expense coverage, is it will also cover other losses that you may incur during a trip like missing luggage, flight cancellation at the last moment, travel agency or accommodation bankruptcy. It can also provide cancellation insurance by giving you full or partial refunds.

Stay safe and enjoy your vacation!

Sunday, February 1, 2015

Video: Lindsay Lohan "TERRIBLE Driver and Sorta Mom" Super Bowl 2015 Esurance Commercial

Lindsay Lohan, 28 who has been jailed for two 2007 DUI arrests, played herself in the commercial sorf of, she sped past a parked yellow school bus and plowed through a "School Zone" sign, that smashed her cars front grills. She then halts to a stop at the curb screeching her wheels in front of two kids who are waiting for their mom.

Video: Walter White is Back in an Esurance Super Bowl Commercial 2015

Walter White is back from the dead and he's tending a pharmacy store in a hazmat suit. It was aired during the 2015 Super Bowl XLIX on Sunday night February 1, 2015.

Bryan Cranston returned as fan favorite Breaking Bad character Walter White in the new commercial for Esurance. He seems to be doing his old stuff blue sky while in the pharmacy pretending to be a guy named Greg. "Say my name"

Thursday, January 22, 2015

Disneyland Hit by measles outbreak

Will you bring your kids to Disneyland where there's a measles outbreak? I guess not. Last December a guest with measles may have visited the park in California and may have pass it to other guest when he/she sneezed. It seems that a lot of people in California don't have measles immunization.

According to a news report 70 people have now been infected by the measles outbreak, and public health officials is advising the public to get measles immunization vaccine. They also warned children under 12 and anyone not vaccinated to avoid Disney parks where the outbreak originated.

Centers for Disease Control and Prevention said, “Measles is so contagious that if one person has it, 90% of the people close to that person who are not immune will also become infected.” People who are infected with the disease can spread measles to others from 4 days before to 4 days after the rash appears.

The outbreak has now spread to 5 U.S. States and Mexico, and new infections has emerged last Wednesday with the total infected is now at 70, which includes 5 Disney employees who have since returned to work. 62 of those who are infected are in California.

People at highest risk are those who are not vaccinated, pregnant women, infants under 6 months old, and those with weakened immune systems. Many Americans don't have this immunization since some says that there is a link between the vaccine and autism.

Saturday, January 17, 2015

State of the Union Address: Obama Wants to Raise Taxes on Wealthy to Finance Tax Credits

President Obama wants to increase taxes on top earners which will include investment tax rates so that the government can fund new tax credits and other measures that he thinks will help the middle class. Included in his proposal is the removal of tax break on inheritances.

He will have a hard time with this since the Republican-controlled Congress are opposed to any tax raise since they claim that any tax increase will negatively affects economic growth at a time the U.S. cannot afford it.

Whitehouse believes that the new tax raise if implemented would raise $320 billion over the next decade, while adding new provisions cutting taxes by $175 billion over the same period. It will also fund the free community college for 2 years that is expected to cost $60 billion over 10 years.

Obama wants to end the “trust-fund loophole” on inheritances that save billions of dollars from taxation yearly. This will require estates to pay capital gains taxes on securities at the time they're inherited. It would also raise the top capital-gains tax rate to 28% (from 23.8%) for family with an annual income of above $500,000. Banks with assets over $50 billion will be taxed and the fund will be used to finance tax incentives for middle-income earners, which includes $500 credit for families in which both spouses work, additional child care and education credits and incentives to save for retirement.

Republican leaders said they also wanted to reform the country's complicated tax code, however they don't agree with most of the proposals the president will outline on Tuesday. For example, most Republicans want to lower or eliminate the capital gains tax and similarly want to end taxes on estates, not expand them.

Republicans support the fee on the banks with more than $50 billion assets. This new fee is the same proposal from former Republican Rep. Dave Camp of Michigan, who led the tax-writing Ways and Means Committee. Camp's plan, however, was part of a larger proposal to lower the overall corporate income tax rate.

If it would help the working middle-class and not the lazy-class, I'm all for it.

Wednesday, January 7, 2015

Jean Yang Executive Director Of MA Health Connector Quits

Jean Yang the Executive Director of the Massachusetts Health Connector quits after a very difficult year in which the state's health care exchange failed in spectacular fashion and fall far behind the federal site when in comes to fixing the problem. Her departure was expected since there is a new Republican governor, Charlie Baker, who is about to take office.

The problems in the connector's website impaired the process of transition from Massachusetts’(1st in the US) universal healthcare insurance law to the requirements of the Affordable Care Act, that left hundreds of thousands of people in the temporary Medicaid coverage.

Maydad Cohen, will took office as interim executive director until the Baker administration appoints a successor.

Subscribe to:

Posts (Atom)